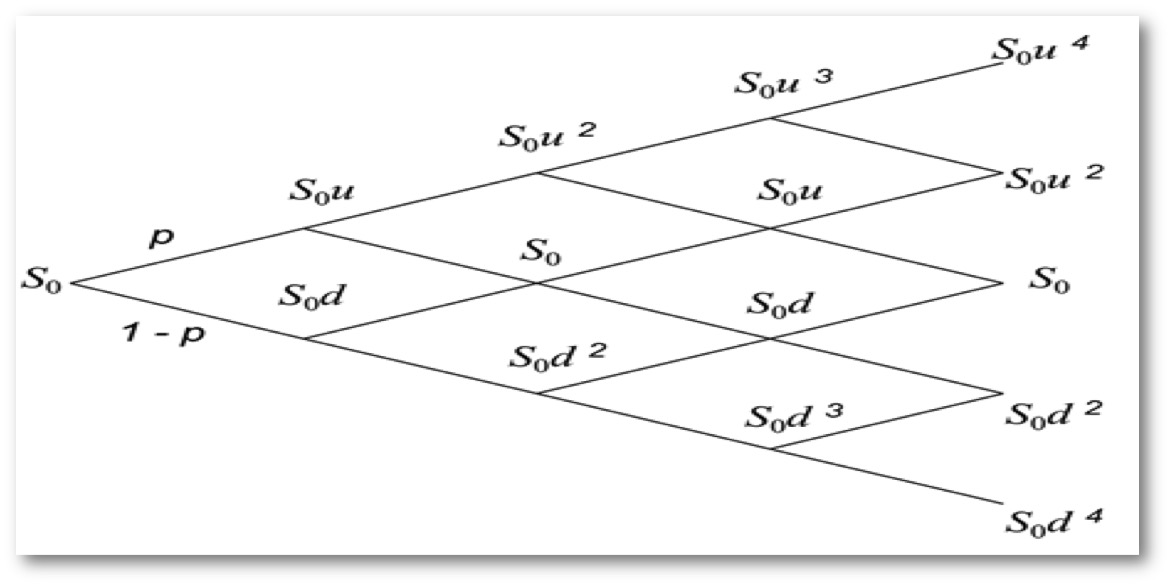

Taking an advanced math class in quantitative finance taught me how to formulate proofs, derive formulas like the Black-Scholes-Merton Formula and the Ito-Doeblin Formula for advanced stock and options pricing. Using this knowledge I created an option pricing algorithm that allows the user to price American and European call or put options based on inputs like initial stock price, strike price, option duration to maturity, the risk-free rate, and volatility. The program prices the option based two different pricing theories: the Black-Scholes-Merton Formula, and the Binomial Tree Option Pricing Method.

Another comparatively simple program I wrote outputs a random Brownian motion which can be used for many modeling applications like Monte Carlo simulations

Feel free to download the two programs on GitHub under Option Pricing and Finance.

Binomial Tree Pricing Model with 4 steps